Impact Report 2020-2021

At Fox & Hare, we are proud to release our first Impact Report, which highlights the impact we have on the environment, society, and our work force.

This Impact Report is for the Financial Year 2020-2021, check it out below.

At Fox & Hare, we are proud to release our first Impact Report, which highlights the impact we have on the environment, society, and our work force.

This Impact Report is for the Financial Year 2020-2021, check it out below.

As Australia’s two largest and most influential economic centres continue to be hobbled by the lockdowns, we sat down with BetaShares Chief Economist, AFR columnist and friend of Fox & Hare, David Bassanese for a breakdown of what Australians (and the world) might expect from financial markets in the near and distant futures.

First, despite the doom and gloom, David believes the global economic recovery and forecast look good. The United States is a standout at the moment, eclipsing a successful but slightly less impressive performance in Europe.

In the emerging markets; after a strong initial performance and stellar job of handling the pandemic in its early stages, China’s growth has slowed. Hampered by a recent outbreak of the Delta variant and a tightening of tech industry regulations China’s initial boom has been tempered. Slow going on the vaccination front is hampering the recoveries of India, Brazil and Indonesia – but the recovery is well under way.

All in all, the global economy is slowly but surely shaking off the pandemic.

The Australian economy has performed well over the course of the pandemic. It is going to take a dip because of the lockdowns hobbling both Sydney and Melbourne – the nations’ largest and most influential economic centres by a long stretch. There’s no doubt we’ve taken a big hit, but the recovery will likely be swift.

If David is to be believed – and we think that’d be a very wise choice – there is no relief in sight for those trying to edge into the Australia property market.

A massive demand for inner city homes, rapidly growing population and dwindling supply means a correction isn’t likely anytime soon.

Despite the surge in prices across the nation, there is one bright spot for those looking to invest in property.

Inner city apartments remain an under-utilised and underappreciated option, especially in light of our cities’ recent efforts to make urban spaces more livable.

Regional areas and even capitals outside of Sydney and Melbourne remain considerably more affordable. That affordability will introduce the extra costs involved in paying somebody else to manage the property for you – whether that cost offsets the savings from a regional buy remains to be a seen on a case by case basis.

Technology stocks have performed incredibly well for the duration of the pandemic. Already surging before the world was forced to switch from in person to online living, the companies facilitating that shift have, naturally, performed very well.

Asian technology stocks appear to be an outlier from the general upward trend, although for many this could be seen as an opening for long term value opportunities.

The surge in tech, coupled with a hit on the value of fossil fuel companies has continued the upward trend in ethical portfolios. One of the more positive messages over the last twelve months has been the realisation that “you can profit from your principles!”.

Check out the whole interview in the video above.

Glen features in the latest episode of ‘Friends with Money’ podcast chatting to Julia Newbould about his business and how starting those important financial conversations is helping his clients to reach their wealth management goals.

People tend to see financial advisers as they near retirement, but the reality is that many gen X, millenials and even gen Zs can benefit from advice when making life’s big decisions such as starting a new job, getting married, buying a house or investing for a secure future. After seeing a gap in the market needing advice in navigating through life stages, Glen Hare and business partner Jessica Brady built on their experience working for big financial firms and formed Fox and Hare, their own financial planning business targeting millennials like themselves.

So what do financial advisers offer millennials? In this episode of Friends With Money, Julia Newbould is joined by Glen Hare to talk about his business and how starting those important financial conversations is helping his clients to reach their wealth management goals.

Listen HERE ? –

Did you know that gay men are the most likely group in Australia to buy a product based solely on the label?

They also spend 25% more per week than anybody else in the nation on clothes.

And a vast majority of Australia’s gay men live within walking distance of their closest CBD.

Read: they live in some of the most expensive places in Australia.

Is it any surprise, then, that the vast majority of gay men I work with at Fox & Hare present as financially insecure?

“Sure!” You might say, “those impeccably dressed, perfectly manicured, uber successful men I see all over instagram are broke – yeah right!”

But it’s true.

First of all, many of those guys you see may be a powerhouse in their own right.

There are gay men who are CEO’s, barristers, sports stars and politicians. But they’re the exception, not the rule.

And I hate to be the bearer of bad news, but a big salary doesn’t necessarily translate into financial security. In fact, I’ve met men who’ve earned six figures for decades and have literally nothing to show for it.

Second, for all of those who aren’t CEO’s, celebrities or monetised social media influencers, the pressure and cost of looking / living like one can destroy them financially. Quite literally leaving them locked out of the property market, steeped in bad debt and financially insecure for the rest of their lives.

An outsized proportion of the gay men we work with at Fox & Hare present as financially insecure – regardless of their income.

In my experience, there are three major mistakes driving gay men into financial strife – and all of them appear to be at least somewhat related.

The first, too many men spend their entire income (or more) in order to simply look/live like a wealthy person.

Many blow astronomical amounts of money on things that they simply do not need. Whether it’s ridiculously expensive branded clothing, over priced cocktails or exorbitant rent in the inner city.

Too many men are living a “feast and famine” lifestyle that will leave them severely under prepared for their later lives.

The amount of men living pay cheque to pay cheque in the gay community should be cause for serious concern, but very few people seem to talk – or even care.

Second, very few gay men are taking the time to properly consider their future.

They generally don’t have to think about supporting dependents or families. As a result they can get sucked into believing they don’t need to think about setting themselves up for later in life.

Living wholly in the present, does not for a bright future make.

What happens when retirement rolls around, income dries up and all that’s left to show is a pair of fallen apart Yeezy’s, a car that’s more than quartered in value and the rental receipts for an expensive apartment in Potts Point? These should be very real concerns for a huge number of people.

Third, too many men are taking on unsustainable amounts of credit card and other bad debt.

The number of times I have met with men who do not know how long it will take to pay off their credit card debts is terrifying.

Even worse, many don’t even know how much their debt is costing in interest repayments every month. Some of them are quite literally throwing hundreds or thousands of dollars into the wind every month.

But for what?

More often than not that interest is being paid on money borrowed to buy already over priced consumer goods.

It’s entirely possible to live the good life and build financial security.

There is (quite rightly) a huge amount of attention paid to the detrimental effects of advertising, marketing and social media on the wellbeing of women.

We must also take time to acknowledge the negative toll that these activities are taking on men – especially those within the gay community.

The pressures to look, act and socialise in a certain way can be all consuming and extremely damaging to our long term health.

Unsurprisingly, it appears the near collective childhood experiences of insecurity, not fitting in and not being good enough have had a long lasting effect. It’s hard to shake off a lifetime of being told you’re not good enough.

I believe that our obsession with “fitting in” is a direct result of the bullying and exclusion we endured at the hands of a homophobic Australia. It manifests itself in a lot of ways, but are we willing to recognise and address these problems?

Whether it’s an obsession with having the perfect body, being perceived as wealthy (and therefore worthy) or compulsive attempts to “buy” the friendship and adoration of those around us – we all know what this kind of insecurity looks and feels like.

I don’t know who needs to hear this but you are absolutely worth more than the sum of your social media following, muscle mass and material possessions.

It might sound cliche, but if any of the financial woes listed above are weighing on your mind, that is actually a good thing.

Acknowledging that you are uncomfortable with the way things are going is the first step toward financial security and long term wellbeing.

Know that financial insecurity does not need to be the default. You can live a wholly fulfilled life AND maintain a healthy bank balance.

If you’re worried about your current financial position and ready to take steps toward financial security, reach out to Fox & Hare for a free coffee and catch up.

We have helped hundreds of people, just like you, unlock their potential.

We can assess your current financial world – and clarify what it is exactly that you can achieve.

Do you want to be bad debt free? We can tell you exactly how long that will take. Do you want to own a home? We can tell you how long that’ll take too.

If you like what you hear, you can tee up a second, commitment free, “Goals and Values Session” and begin to unearth what’s been holding you back and why.

We’re close to fully booked for the next two months and take on a limited number of new members every month, so if you’re into it.

DISCLAIMERS*

The information in this article is based on my own experiences as a Financial Adviser based in Darlinghurst, Sydney. If what I have seen in my work is reflective of many in the wider community, we should be paying a whole lot more attention to our finances. We, as a community, have some serious problems to address.

I understand that headline generalisations can never be truly reflective of an entire cohort or community. However, my professional experiences and the research conducted for this article appear to support my concerns.

Key takeaways

Who are Vanguard?

In what are, for many, completely unprecedented times – economic uncertainty seems like a given. However, if we were to believe the forecasts and predictions – it would be Vanguard.

With more than $6.5 trillion in assets under management, over 30 million investors worldwide and more than 40 years experience in the investment space – Vanguard have the credentials and understanding to offer the closest thing to clarity we can expect in the most uncertain times.

At Fox & Hare we were lucky enough to get front row seats for the release of their mid-year Economic and Market Outlook (VEMO) and thought our members would be interested to see what the future (probably) holds for the global economy and, by extension, their investment portfolios.

Where are we now?

Let’s start with the obvious.

The global economic outlook, as expected, hinges on global health outcomes.

According to the guys at Vanguard “no matter how we look at it, the pandemic is still far from over”.

The emergence of new variants, lockdowns and hotspots only serve to demonstrate this fact. However, despite the doom and gloom, there are numerous reasons to remain hopeful.

Macroeconomic indicators signal that the global economy is rebounding – from the sharpest contraction in modern history – faster than many had expected.

Naturally, nations that have contained the virus successfully, whether through vaccinations, lockdowns or both have tended to see their economies weather the storm better.

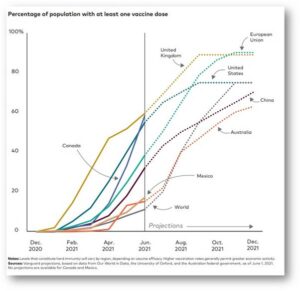

It is estimated that 75% of the global population will receive at least one dose of the Vaccine before 2021 is out (see fig.1) – putting herd immunity in the world’s largest economies within reach.

Fig.1 Different vaccination rates are likely to produce different economic growth.

However, an uneven global response all but guarantees continued unevenness in the recovery for the rest of this year and beyond.

So, how does the world shape up? Here are the predictions for the world’s major economic areas:

Global Growth Outlook

Interested to learn more?

Check in here to read the full report.

Interested to learn more again?

Sign up for our upcoming quarterly economic update with Fox & Hare Co-Founder Jessica Brady and Chief Economist, David Bassanese to discuss:

✸ The current state of the market

✸ What opportunities are on the horizon investors can leverage

✸ David’s predictions for the future

+ Answers to all of your burning questions! ?

In the latest episode of our Ask the Experts series, Glen chats with Catherine Elversson, Senior Manager and Estate Planning Solicitor at Australian Unity to unpack why everyone should have an Estate Plan in place (even if you’re young and healthy).

Estate Planning might seem like a problem for future you, but failing to act when we’re young and healthy can have major consequences including but not limited to, how our assets are distributed when we’re no longer here.

We’re thrilled to be joined by Catherine Elversson, Senior Manager and Estate Planning Solicitor at Australian Unity. Catherine brings over 13 years’ experience in Estate Planning to this conversation having worked at some of Australia’s top financial institutions.

In this conversation, Glen and Catherine covered a bunch of topics including:

What is an Estate Plan, and what does it actually include?

Catherine reveals that alongside your Will, there are a range of additional important documents you need to prepare “as an Estate Planning Solicitor, I pull together a range of documents that will form your Estate Plan, including Wills, Power of Attorney documents and Enduring Guardianship,” explains Catherine.

“Whilst you are still alive and if you were to be deemed incapable of looking after yourself, that’s where the Power of Attorney documents are followed. However, once you pass away the Power of Attorney documents become invalid and your Will is now considered the key document in your Estate Plan.”

If you don’t have an Estate Plan in place and you pass away, the law steps in and will make decisions on your behalf on how your assets are to be distributed. This is why it’s so important to get this sorted when you’re young, healthy and have the capacity to make these significant, legally binding decisions so that there is a clear plan in place.

“We’re at a stage in our lives where we’re all working hard to accumulate our wealth, but it’s just as important to make sure it passes on properly to our children or family members,” tells Catherine. “An Estate Plan makes the process of organising your affairs smooth and seamless. Your loved ones will be grieving, so you want to do everything you can to avoid putting extra stress on them.”

Scenario 1: What happens if you’re single, you’ve purchased a property and you don’t take out a Will?

Before we dive into this example, we want to unpack a legal jargon term known as probate.

Catherine explains further, “generally, if you’re a single person your assets go to your parents and in the majority of situations I see like this, people don’t actually want to give everything to their parents.”

Scenario 2: What happens if you’re in a committed relationship – is a Will still required?

While there is the assumption that if you’re in a de facto relationship your assets will automatically go to your partner, that isn’t always the case. “Whether you’re a married couple, de facto or a same-sex couple, a Will adds certainty and clarity. It ensures that everything goes smoothly and quickly if the worst was to happen,” tells Catherine.

“As you don’t have a marriage certificate when in a de facto relationship, you have to produce additional documents (such as a Statutory Declaration) to prove that you were in a long-term relationship.” Again, it’s more paperwork and roadblocks for your partner to navigate when you’re no longer around.

The key reasons why an Estate Plan is so important:

What you might not know about Super, Insurance and your Estate Plan

“Most people believe that Super is automatically included in our Will. But, that’s not the case,” reveals Catherine.

“Your Super and life insurance is what we call a non-Estate asset and isn’t automatically captured as part of your Will. You need to get proper advice from your financial adviser and solicitor to make sure that your Super and/or life insurance goes to the people you want it to. Plus, you need to ensure you’re making valid nominations,” Catherine explains.

The valid Super beneficiary nominations include:

Our top takeaway points

Want to learn more about becoming a Fox & Hare member? Click here to book in for a quick chat. ?

In the latest episode of our Ask the Experts series, Jess chats with Nicola Powell, Senior Research Analyst for Domain, to deliver your need-to-know guide on the Australian property market right now.

Are feeling overwhelmed, hopeless, or confused about the state of the Australian property market? There’s no question that property prices are rising at exponential rates across the country. So, is now the right time to buy or sell? Are there signs of it slowing down?

Get ready to have all your burning property questions answered!

We’re thrilled to be joined by Dr. Nicola Powell is Senior Research Analyst for Domain. Nicola is the leading force behind Domain’s data reports that keep the Australian public up to date on what’s happening in the market. She is a well-known property expert, featuring regularly on broadcast and in print media, as well as Domain’s media channels.

In this conversation, Jess and Nicola covered a bunch of topics including:

✸ What’s driving the market conditions around the country?

✸ What to be wary of when buying or selling property now

✸ How to expand your options if you can’t afford to buy in the area you want to live in

✸ Weighing up the risk of buying at potentially the top of the market

✸ How to decide which area of Australia fits what you’re looking for in property + MORE

What is causing Australia’s exponential growth in property prices?

It’s the question on everyone’s lips: what the heck is going on with property prices across Australia?

Nicola explains that stats we’re seeing across the country are incredibly unique. “The conditions that we’ve seen in 2021 so far are very rare and unusual,” tells Nicola.

“We’ve got record-high property prices nationally across our capital cities. The median price is almost at $900,000, and Sydney is much higher than that at $1.3 million. We saw the steepest quarterly gain in 18 years,” explains Nicola.

The rate of growth is being seen in all parts of the country, which is another rare trend Nicola points out.

“The most notable trend we’ve seen to date in 2021 is that every single capital city in Australia is posting quarterly capital growth. It’s the first time house prices have risen simultaneously for two consecutive quarters since 2009 (post-GFC),” she explains.

So, what are the reasons causing this lift in prices nationwide? Nicola points to a few things:

“Sydney and Canberra have seen the strongest quarterly gain on record in 2021. These records go back 30 years, so it’s been a rare and phenomenal period of growth,” reveals Nicola.

As for what lies ahead for the rest of 2021, Nicola expects prices will continue to rise, but the rate and pace of growth will slow down. As affordability becomes a big issue (and many buyers become priced out of the market) and stock levels increase, price growth is predicted to ease in the second half of 2021.

How are different states and capital cities performing in Australia?

But there are different trends in different parts of the country, with Nicola explaining what she is seeing in a handful of Australian cities.

As for property types, there’s a clear trend in price growth between units and houses. “Units have underperformed when compared to houses, but there are signs of opportunity. Low-density apartments geared towards owner-occupies with unique features (such as heritage features) will always have a strong appeal and hold value,” tells Nicola.

Why have regional areas in Australia seen booming property prices?

In 2020, 43,000 Australians moved from cities to the regions (compared to just 19,00 the year prior). Naturally, property prices have also risen sharply in these regional areas as a result.

Nicola explains, “We saw stronger rates of growth in regional areas in 2020 than in our capital cities, which is a pretty big statement, particularly for NSW and VIC. We’re starting to see that change, with stronger rates of quarterly growth in our capital cities compared with regional markets.”

Nicola believes that the pandemic accelerated this exodus from the cities because Australians enjoy the lifestyle, affordability, and ability to work from home that the regions enable. But she cautions that we might see some of this trend reverse as more “normal” working habits resume.

As for investors, Nicola recommends investors look for 3 things when investing in regional areas:

How are these market conditions impact first home buyers?

Obviously, these booming market conditions are causing many first home buyers to feel despondent about their chances of cracking the property market.

While prices are still tipped to rise in 2021, Nicola believes the most dramatic growth in prices are behind us. She points out that there has been an increase in property listings which should help to relieve the pressure on the market in the second half of 2021.

While Nicola believes it’s important to seek specific advice to find out what’s the right move for your situation, she does remind buyers that the average age of first home buyers in Australia is rising.

“In Australia, the average age of a first home buyer is 35 years. We’ve seen that track higher in recent years. That’s because the way we live our lives has changed: a higher majority of us are going to university, we’re settling down later in life, we’re starting families later, etc.,” tells Nicola.

Our top takeaway points

While there were stacks are expert insights shared during our session, these are our biggest takeaways:

Want to learn more about becoming a Fox & Hare member? Click here to book in for a quick chat.

We love helping our members create clarity and make smarter money decisions. And this year, we’ve helped more people than ever before to take the first step towards financial freedom.

To give us the ability to continue this exciting period of growth, we’re thrilled to share that the Fox & Hare family is growing too. We can’t wait for you to meet our duo of new Financial Advisers who will be helping our members to financially thrive in 2021 (and beyond).

Without further ado, let’s get acquainted!

Meet Simon Wulf

First up, we have Simon. After a rewarding and diverse career as a Chef, Simon made the exciting pivot into financial advice (and he’s never looked back).

In 2016, Simon obtained his Bachelor of Business (Financial Planning) and in 2017 he continued to sharpen his financial toolkit by completing the Horizon Adviser training program. Over the next three years, Simon worked at ipac/AMP Advice, helping his clients to articulate their goals and create a plan of actionable steps to achieve them.

From new clients to corporate partners, Simon has worked across a wide range of advice areas. Simon is passionate about demystifying the complexities of personal finance and loves helping his clients achieve focus and clarity through informed financial decision-making.

3 fun facts about Simon

Meet Elise Aricheta

Say hello to Elise! Elise has been working in financial planning since 2004 with a variety of businesses from large corporates to small boutique firms.

With a Master of Financial Planning and a Bachelor of Business and Commerce (Majoring in Accounting) under her belt, Elise brings a wealth of experience to the Fox & Hare family. Plus, she’s also a Certified Financial Planner, Tax (Financial Adviser) Agent, and has completed the FASEA Financial Adviser exam. Talk about a stellar resume.

Elise has a fine-tuned understanding of financial planning and has the expertise to plan, implement, and present financial plans. She’s worked with a broad range of clients with both complex financial needs (such as self-managed super funds, companies, trusts, and partnerships) as well as more straightforward needs (such as retail and industry super funds).

3 fun facts about Elise

We’re thrilled to welcome Elise and Simon to the Fox & Hare family and can’t wait to see the goals they help our members achieve.

Ready to get your finances sorted in 2021? Book in for a quick 15-minute chat with one of our amazing advisers here.

Our very own Glen recently joined podcast host Glenn James on the My Millennial Money Podcast.

Did you catch Glen on one of the latest episodes of My Millennial Money? In this conversation, Glen chatted with Glen James about:

? His earliest experiences with money

?? His own coming out story

?? What it’s like shifting from corporate to building a business

?? The inclusive work we do at Fox & Hre

?? Tips for starting a business

? The potential costs of starting a family

?? Narrowing down on what you want and setting up your cash to suit + more

Want to hear the full conversation? Watch now below!

In the fourth episode of our Ask The Experts series, Jess sits down with Ange Ritchie, Founder and Head Goal & Life Coach of My Goal Squad, to discuss the importance of goal setting to helping us unlock the life we want.

Welcome to the fourth instalment of our Ask The Experts series. In this session, we’re tackling one of our favourite topics: goal setting.

But before we dive in, here’s a little bit more about Ange. Ange Ritchie is the Founder and Head Goal & Life Coach of My Goal Squad and is a passionate goal-setter and goal-kicker, helping her clients to leverage goal setting to create clear direction and build a purpose-led and meaningful life.

Ange is also kicking goals outside of the office, ranking in the Top 25 world champions for the 70.3 Half Ironman Triathlon and she ranked in as the 2nd Australian female and the 35th female overall in her very first marathon she ever ran (the New York Marathon). Talk about massive achievements!

In this session, Jess and Ange cover off a bunch of important topics including:

Ange’s insights on goal setting

Here at Fox & Hare, we work with our members to explain the link between values and our financial world, and the importance of putting our time, energy and money towards the things we value most. Why is this important? Because too many people are just ‘winging it’ when it comes to their personal finances (which is the opposite of what they’re doing at work when they’re running and building successful businesses).

And the same story is true when it comes to goal setting. Ange explains that the most successful and fulfilled people use goal setting to keep them on-track, supported and accountable every step of the way.

“Goals gives you focus. When you have great focus, you can get rid of the stuff that you might be ‘busy’ with in life without actually being productive,” tells Ange. “Once you refocus on what’s most important, you’ll be able to find extra time to dedicate to the things and people that you value as well.”

While the act of goal setting is often lumped in the bucket of meaningless New Year’s Resolutions, there’s a lot of powerful research about the impact that goal setting can have on our lives. As Ange explains, “83% of people don’t set goals. There’s a lot of people that live life by ‘default’ or the path of least resistance, kind of like sitting in the passenger seat of an Uber where you just accept where the driver is taking you.”

But for those that do set goals, the results speak for themselves. “There are roughly 14% of people that set goals without writing them down. In fact, they are already 10x more successful than people who don’t set goals. But then there’s 3% of people who have their goals written down and they are 30x more successful than those who don’t create goals,” explains Ange.

Take it from one of our favourite celebs, Jennifer Lopez (J.Lo), who at the beginning of her acting career had a specific goal, to start in a romantic comedy ““When I first started, one of the things that I wanted to do—because I was Puerto Rican, Latina—was I wanted to be in romantic comedies,” she told The Hollywood Reporter. “Because I felt all the women in romantic comedies always looked the same way. They were always white.”. J.Lo went on to star in many box office-busting rom-coms, most notably 2001’s The Wedding Planner.

Another incredible actor, Tom Hanks sits down with his family once a year and together make a list of goals they all want to achieve: “We sat down with the family and everyone had five realistic goals to achieve over the year, that we can help each other out with. My number one was to wear suits more often. Another was to exercise 300 days of the year. For an hour a day. I get 65 days off.”

When it comes to goal-setting, Ange explains that we need to factor in all aspects of our lives to ensure we’re setting ourselves up for success. “When I set goal with my clients, it’s holistic. It’s about setting goals in all areas of our lives. And whether we realise it or not, our financial goals are deeply interrelated to our personal goals,” tells Ange.

Think about it like this: if you have a personal goal of taking a career break to travel or study, you will need a financial safety net to allow you to step away from work.

One of the most interesting insights Ange shared during our discussion was the importance of turning big picture goals and visions into actionable steps. In fact, she says one of the biggest things most people miss when creating goals or New Year’s resolutions is breaking them down into daily, weekly and monthly milestones to ensure they succeed. “Having real clarity means you know exactly what your goal is, when you’re going to achieve it, why you’re doing it and all the steps you’ll need to take to achieve it,” explains Ange.

Our top takeaway points

Here are Ange’s top tips you can implement today to use goal-setting to help you create a life you love:

Keep an eye out on our social channels and upcoming newsletters for more information about our next Ask The Experts live Q&A session. Want to learn more about becoming a Fox & Hare member?

Click here to book in for a quick chat. ?

In the third episode of our Ask The Experts series, Glen sits down with high performance coach, facilitatory, speaker and consultant Kate McKenna to discuss productivity, mindset and how to harness peak performance.

Our Fox & Hare members will know how much importance we place on values. In fact, it’s one of the first things we chat about in our initial coaching sessions with our members!

Each of us have a core set of beliefs and values that we can harness to help take control of our personal, professional and financial world. Once we figure out what’s important to us, we can clearly map out a plan for how to use our energy, time and money to help us reach these goals. And the same goes for using your values to drive your performance in your personal and professional life.

We’re thrilled to be joined by high performance coach Kate McKenna for this next instalment of our Ask The Experts series. Having worked with Glen at Macquarie Bank for many years, Kate brings a wealth of experience to our community with a background in advice and financial planning, project management as well as a keen interest in health, wellness and peak performance. Kate is also the Program Coach for The Academy (created by leading talent agency The Lifestyle Suite) which delivers a unique 12-month program designed for experts and professional athletes to help grow their brand and drive their profile to new commercial heights.

In this conversation, Glen and Kate cover off on a range of topics including professional and personal high performance, mindset and accountability and how to get in-tune with the way you’re built to work.

Kate’s insights on productivity, performance and energy levels

During our conversation, Kate explored the importance of identifying how and when we work best. Through her work, Kate leverages neuroscience and psychology principals to develop tailored performance strategies for her executive clients, helping them to create clear roadmaps for achieving their goals and objectives. Sound familiar? It’s not far off the same approach we follow with you as a Fox & Hare member!

What Kate’s work uncovers is that each of us is wired differently, meaning we need to adopt an approach that’s unique to how we work best. In essence, it’s all about working smarter not harder to achieve better results in a more efficient way that’s right for us.

But for many of us, this isn’t something we’re taught from a young age. “We aren’t necessarily taught to be clear on our purpose and the value sets that we hold and the reasons why we do things a certain way,” explains Kate. In many cases, Kate explains we only encounter this when we reach a point of crisis, such as burning out at work, which forces us to reconsider the way we are working in our personal and professional lives.

Whether you’ve reach breaking point or not, it’s important to tune into your energy levels, passions and core values to understand how to break out of the ‘hamster wheel’ cycle. This concept of personal accountability is a challenging one, but so important to helping us realise we’re in the driving seat of our own lives.

As Kate explains, “it means no excuses. You create your world and it’s the choices we make that directs us towards which path we’re going to go on.” It’s about taking ownership of your decisions and understanding how these influence the outcomes you achieve.

And this is exactly what we help our members do at Fox & Hare. We believe everyone is accountable for their finances and it’s up to each of us to take responsibility to review our cashflow and lifestyle choices and acknowledge how our actions will impact our ability to meet our goals. Once we do this, we’ll be in the best position to rewire and improve our habits and behaviours to hit these goals sooner.

But change doesn’t happen overnight, as Kate tells, “think about it like going to the gym: you don’t go to the gym once and expect the run a marathon.” The same goes for our financial world: we need to commit to consistent actions over the months and years to come to build sustainable, long-term wealth.

Our top takeaway points

Here are Kate’s top tips you can implement today to improve your energy levels, mindset and productivity.

And for those of us who are feeling depleted by the demands of remote working during COVID-19, here are a few simple actionable tips from Kate:

Keep an eye out on our social channels and upcoming newsletters for more information about our next Ask The Experts live Q&A session. Want to learn more about becoming a Fox & Hare member? Click here to book in for a quick chat.

In the second episode of our Ask The Experts series, Glen sits down with property expert Kellie Landrey to discuss the state of the property market.

One of the most popular topics of conversation we’re having with our members is about all things property. From questions about when to purchase an investment property to tips for finding tenants during a down market, our members are looking for guidance they can trust about how to navigate these uncertain times.

We’re having a lot of conversations with our members about what the future looks like, particularly regarding the property market. Many of our members are asking us what the market opportunities will look like post September 2020 (particularly when the government support packages begin to wind back).

To help point our members in the right direction, we called on property expert and Principal Buyer’s Agent at Scoutable Kellie Landrey to help explain what’s really going on in the property market. In Episode 2 of our Ask The Experts series, Kellie explains what the reliable property data reveals about the prospects for the market, her predictions for the end of 2020 and beyond as well as her tips for renters, first home buyers, first time investors and more.

Although these live Ask The Experts sessions are available exclusively to our Fox & Hare members, we wanted to share some of Kellie’s top insights with the rest of our community. Want to learn more about becoming a Fox & Hare member? Click here to book in for a quick chat.

Kellie’s insights and predictions for the market

Right now, the headlines are making most of our members pretty pessimistic about the state of the property market. But what’s really going on? Kellie explains the shift we’ve seen in the past few months and how this has changed since the optimism we saw in late 2019.

“A lot of people were predicting that we were going to have double digit growth in 2020,” explains Kellie. “We were seeing really limited supply and people were rushing out to buy towards the end of last year. Basically, we were gearing up for the market to be quite strong.”

However, things changed a few weeks ago. “Up until March when COVID-19 hit, that’s how we were tracking. Everything has pulled back since then, but not necessary as much as the media has been portraying it.”

Kellie emphasises how important it is for everyone to look to trustworthy sources and not get lost in a sea of misinformation. “It important to look at the reliable facts and figures that are coming out. The main industry body that is providing the research data about Australian property is called CoreLogic. At the end of each month they release what the results have been for the market (including rentals, sales, stock listings, growth rates etc.),” Kellie explains.

“If we look at CoreLogic’s April results report, the growth rate across Australia as a whole is at 0.3% in April and in March it was 0.7%. So, what we’re seeing is that the growth rate has halved, but we’re certainly not in massive negative territory.”

But we are seeing a significant decline in the volume of listings on the market, with Kellie noting “listings are down almost 40% from this time last year, which is huge.”

In terms of differences across different sections of the market, Kellie has seen a few interesting differences between the top and bottom of the market. “What we’re seeing is the upper end of the market ($3 million+) is having a higher reduction in pricing than the lower end of the market. The growth rate for the upper end were roughly around 6% last quarter, and they’ve halved to just 3%. In comparison, the lower end of the market ($500,000 to $1.5 million), it has seen a smaller movement,” explains Kellie.

And when it comes to the big question of interest rates, Kellie shares her insights into what we can expect over the next few months and beyond. “I think it’s very unlikely that interest rates will increase significantly in the foreseeable future. The economy and market environment that we’re in just won’t support that kind of growth,” tell Kellie.

With so much uncertainty, many of our members feel unsure what the future of the market looks like. But Kellie reminds us that this isn’t the first down period the property market has experienced. “We have been in recessions before and what always happens is when that period finishes, the market always goes up and recovers,” assures Kellie.

Our top 3 takeaway points

Although Kellie shared countless valuable insights into all things property, we wanted to break down our top takeaway points from this valuable conversation. So, what are the most important tips Kellie shared during our chat?

Kellie reminds us that it’s important to consider our personal circumstances and think about our property journey so far. “If you’ve found the perfect property right now, think about how long you’ve been looking for and what are the chances of the kind of property being on the market again.”

“If you’re doing your research and making a wise investment decision, your property purchase will most likely weather the storm (even if its value does drop a little bit in the short term). Even if you do experience levels of fluctuation in the next 12 months or so, the property’s value will recover over time,” tells Kellie.

So that means if the external factors of your financial world (such as employment and financial security) are stable, and you find the right property now, there’s no need to wait until the end of the year to make a property purchase.

One of Kellie’s best tips during our session was about doing practical market research before making an investment purchase.

“The best way to assess stock levels is to jump online to a real estate website, check the suburb you’re looking to buy in and assess how many similar properties are available. Scope out your competition and see how these properties compare to yours in terms of quality, location and condition,” explains Kellie.

And to help you purchase at the right price, make sure to do your research. “If you price your property accurately in terms of your competition, you’re more likely to secure a tenant. You might need to come in a little lower, but that means you’ll then make that reflect the price you’re willing to pay when purchasing.”

When it comes to finding the right investment property, it’s all about scouting out a property that is desirable and unique.

“Look for a property that’s limited in supply. That means looking for styles of properties that you won’t find an abundance of in the same suburbs,” tells Kellie.

“We want to look for a property that has access to public transport, retail amenities, and easy access to the CBD. That means the property will have good demand from tenants and good future demand for buyers when you eventually want to sell.”

Keep an eye out on our social channels and upcoming newsletters for more information about our next Ask The Experts live Q&A session. Want to learn more about becoming a Fox & Hare member? Click here to book in for a quick chat.

So, you’re earning decadent coin. Now what? Discover the simple steps you can take today to optimise your personal finances.

Managing a successful business is all about understanding numbers and figures. From keeping tabs on cashflow to ensuring you have the resources to meet deadlines on-time, being in charge of a business means being organised, efficient and well-prepared.

But in many cases, the same can’t always be said for our personal finances. While we might be kicking out professional KPIs, setting up budgets and investment strategies for our personal finances can too often be overlooked. If you’ve worked your way up in a lucrative career but feel lost when it comes to managing your wealth, keep reading to discover 4 simple ways you can optimise your personal finances today.

Treat Your Personal Finances Like A Business Budget

You wouldn’t take on a new project at work without a budget, so why run your personal finances without a plan in place? The first step to taking control of your money is to create a budget that clarifies your income, expenses and savings goals.

Just like you’d do in a professional context, start by establishing your fixed costs (including rent, mortgage repayments, bills and your gym memberships) and then factor in any variable costs (such as eating out, weekend getaways and even the occasional new pair of shoes). Next, look at how much income you generate on a weekly basis to create a budget to manage your income. With a plan in place, you’ll understand how much money you have to play with on a weekly basis to set yourself up for success now and into the future.

Track Your Expenses And Analyse Your Cashflow

Even if you’re on a generous salary, it can be easy to overspend and end up with nothing left in the bank at the end of each pay cycle. To get on top of your money, review and track your expenses across a 7-day period to see exactly what you’re spending your money on. If you notice unnecessary expenses or poor spending habits, this is your opportunity to take action and make some changes to the way you are managing your cashflow. Could you swap your daily almond croissant for pre-made brekkie from home, or pause the gym membership you haven’t had time to use?

Make Your Money Work Harder For You

Not sure what you should be doing with your savings? The best way to make your money work harder for you is by exploring your investment options. Although all investment options come with a level of risk, investing is one of the most effective strategies to help you build long-term wealth.

Too often we see people avoid investing altogether because they are confused about what options are out there. But, particularly for those of us generating a good salary, investing in an asset class that aligns with our appetite for risk is one of the best ways to grow your wealth.

If you’re looking for a low-risk investment option, you could consider defensive assets such as high-interest saving account or a term deposit. However, if you’re happy to accept a higher level of risk, growth assets such as shares or property could be a wise investment strategy for you.

Set Regular Non-Negotiable Check-Ins

Just like you would schedule regular meetings for big projects with your team, its essential to set time aside to regularly check-in with your personal financial life. Treat these check-ins like non-negotiable appointments and even consider bringing your partners into the conversation to discuss your personal finances together. Whether you catch up quarterly, bi-annually or annually, make sure these meetings are focused and take the opportunity to assess how you are tracking towards your long-term financial goals.

We love celebrating the wins of our members (both big and small). So, we wanted to share their stories with you.

Meet Robbie, one of our members here at Fox & Hare as he explains his coaching journey with Jess. Hear his story in our video or read the full transcript below.

“I had decided it was time to change my financial position. I needed help with a couple of things: learning how to better manage my debt and I wanted to feel as if I was in control of my finances. I’d always felt very out of control and I was earning a great wage. So, money was coming in but it just felt like money was going out just as quickly.

Prior to joining Fox & Hare, I had seen a couple of advisers. Meeting those advisers, what overwhelmed me was that it felt like it was a sales process and I felt as though they weren’t listening to me. But with Fox & Hare it was focused on what I wanted to do and so they worked with me on my goals and the things that matter to me the most.

It helped me dream about what was possible and helped me clarify what I wanted to achieve. Prior to that, I’d been floating along pay-check to pay-check, holiday to holiday. And to be honest? It was all a bit of a car crash. Jess helped me focus on the key things that I wanted to achieve.

The way that I describe Fox & Hare is that Jess is my coach. She’s there to guide me and train me, but there’s also a big element of support. One of the best things that has come out of this is that I trust Jess implicitly. I know that she’s got my back and that advice I’m getting isn’t biased and it’s in my best interests.

If I hadn’t seen Fox & Hare I think I would be on the same merry go-round. I also think I wouldn’t have clarity in terms of what’s most important to me and the goals that I’ve wanted to achieve. Now, I’ve got my debt under control and I’m almost at a point where I’m a couple of months away from being bad debt-free.

I think the biggest thing that I’ve achieved is that I have structure around how my money is being managed. I haven’t had to think about juggling bills. When I need money for a particular purpose, the money is in that account and ready to go.

This process has made me excited about my finances. From an education perspective, I’m now interested in making proactive decisions about my money and my future.”

Want to know more about becoming a F&H member? Click here to book in for a quick chat.

We love celebrating the wins of our members (both big and small). So, we wanted to share their stories with you.

Meet Sami, one of our members here at Fox & Hare as she explains her coaching journey with Glen. Hear her story in our video or read the full transcript below.

“I had been traveling overseas for a couple of years. I don’t regret anything, but I came back with nothing. So, I reached out to Glen for some advice because, to put it bluntly, I was sick of being on the credit card hamster wheel.

My perception of financial advice before I came to Fox & Hare was that it was for people who already had money and investments, and those who wanted to maximise their returns and make more money. I thought, “I’m at a starting point with nothing. What am I going to be talking about?”

I was expecting it to be a little bit more judgemental. I know that probably sounds a bit funny but I thought it would involve reading my bank statements and interrogating what I’m spending on, like “what are all these shoes?” I thought it would focus on cutting back on all these things I love, but that wasn’t the case at all.

We’re younger people who are living this modern lifestyle. The cost of living is really expensive and the desire to travel is there. It’s not all about shares and I still have my shoe habit that I can keep.

Some of the goals I’ve been working towards are getting my cashflow sorted, paying off my credit card and trying to get my finances in control so I can focus on my savings. My ultimate goal is to buy a property.

So when I tell my friends I’m seeing an adviser, I think they’re shocked. I suppose they think that’s strange and unusual. But when I explain to them the reasons why I’m here, they’re really receptive to it.

I can really relate to Glen because he’s a similar age to me and he understands the modern lifestyle. That means I still want to maintain a social lifestyle and eating out while still working towards my long-term property goals.

After working with Fox & Hare I feel so much more relaxed about seeking financial advice. I used to have a lot of anxiety around money. I wasn’t focusing on it and things were just spiraling. But now I’ve got a set-and-forget strategy in place and if feels like a weight has been lifted off my shoulders.”

Want to know more about becoming a F&H member? Click here to book in for a quick chat.

In the first episode of our Ask The Experts series, Jess discusses the current state of the market and opportunities on the horizon with Chief Economist, David Bassanese.

When it comes to investing, there’s a sea of information to wade through. We understand finding valuable insights can be complicated and confusing, which is where our Ask The Experts series comes in. In this new video series, we sit down with leading industry experts to answers our community’s burning questions on investing, property and everything in between.

In Episode 1, Jess sits down with Sydney-based Chief Economist David Bassanese. As the author of Australia’s leading guide to exchange traded funds, a senior financial columnist at the AFR and with previous experience at the Federal Treasury, David has a wealth of experience in navigating the financial markets.

In this conversation, Jess and David discuss his predictions for equity markets, the current state of markets globally as well as any areas of opportunity on the horizon. Let’s take a look at what the pair discussed in this exclusive Q&A session.

David’s insights and predictions for the market

With the headlines constantly reminding us how turbulent the markets are, we wanted to get David’s two cents on the current state of the market.

In his view, “we are clearly in a global recession, and it’s a very deep recession. The only question really is how long this recession will last,” tells David. “With the Coronavirus shutdowns, the economy is incredibly weak. Basically, we’ve gone into a period of hibernation.”

But David also notes that some small gains have been made in recent weeks as countries across the globe begin to ‘flatten the curve’. “If you look around the world, countries are slowly and gradually beginning to open up their economies again,” tells David. “In recent weeks the markets have rebounded on the hopes that we can reopen quickly and get things back to normal. We’re really in that stage of trying to get businesses back open, which could mean we’ve seen the bottom in the equity market and things can continue to rebound.”

However, David is quick to temper his optimism as he reveals, “the outlook of the markets is really dependent on the outlook of this virus. That means we need to consider the likelihood of a second wave of infections as restrictions begin to lift. We’re still grappling with understanding the severity of this virus and so that cautions any predictions we can make at this stage. Although we have seen some level of recovery already, I think markets are too optimistic. I don’t think we’re out of the woods yet,” David explains.

In more positive news for investors, David does share that there will be some opportunities for investors looking to enter the market.

“Usually in recessions, markets can fall a long way and get very cheap. So, the bad news is that markets are down (and could even go down further), while the good news is that there are new entries points into the market from a longer-term perspective. Now could be a good time to buy into weakness and edge in while markets are down. It’s better to be buying now rather than buying at the market high where valuations are very high,” tells David.

During the conversation, Jess and David continued to discuss the broader implications of COVID-19 on the markets and how this has impacted investor behaviour. Plus, David shares his expert insights into questions such as “do you think the equity markets will fall further when businesses post their full year results?” and even if he has “any views on the potential impact of the upcoming US elect on the market?”.

Our top 3 takeaway points

Although David shares countless valuable insights in this conversation, what are the top 3 points to take away from this conversation?

What our members thought

We were so thrilled to have so many of our members tune into this live Ask The Experts session. Here’s what a few of our members had to say following the broadcast:

Keep an eye out on our social channels and upcoming newsletters for more information about our next Ask The Experts live Q&A session.

Want to know more about becoming a F&H member? Click here to book in for a quick chat.

To celebrate Mothers Day a little differently this year, the Ladies Talk Money team used their How to Talk About Money guide to chat to their mums.

Ladies Talk Money and Fox & Hare’s Co-founder and Financial Adviser, Jess chats with her mum Denice about their top tips, biggest challenges and much more here –

What’s the best money or financial advice you have ever received?

D – Probably to salary sacrifice, to invest in shares, and make additional contributions to my Superfund. And always remember that money doesn’t buy happiness.

What did your parents/grandparents/teachers/first boss teach you about money?

D – From a very young age (before I was even 10-years-old) my father drilled into me the importance of money. He used to always say to me, “money makes the world go round”. My mother would spend lots of money on having a lot of “things”, because during the war when she was going up, things were so scarce. Both my parents worked while I was growing up, and my mother had a very good job as a financial manager for a global company.

That was really different from the norm of the time, with most other mothers staying at home (with only a handful of working mothers). She ran the family finances and that taught me how to respect money and it’s always made me want to be involved in the financial management of my own household.

J – I remember my grandparents being very cautious about money and always being focused on having ‘no waste’. I’d say they were the world’s best hoarders.

How has your approach to money changed throughout your life?

D – I don’t think it has really. I like to take risks and I’m not scared to roll the dice, see what happens, and accept the outcome. I don’t like to look back. It’s served me well and has enabled me to live a comfortable life.

What have been some of the biggest financial challenges in your life?

D – Being a widow at 25 with a four-month-old child. Luckily, my husband had taken out insurance and I think I had $25,000 that was left in my name. A big chunk of that went to the funeral expenses and moving back to Australia from New Zealand. That was definitely a very challenging time for me, but I got through it.

In my second marriage, my husband injured his back right after I had my son so I had to go back to full-time work very shortly after giving birth. Beforehand, I had been planning to take a long time off, but then a girlfriend suggested I consider going back to work and it turned out to be a really good decision and a helpful piece of financial advice.

I’m a huge advocate for insurance because I’ve lived through the benefits of having it. In fact, my first husband only took out insurance a few months before he became sick and it turned out to be such a wonderful gift for us.

If you could give one piece of financial wisdom to future generations, what would it be?

D – Don’t listen to negative people in your life and do what is right for you. For example, when we bought our house someone said to us they thought it was too expensive, and now it’s worth a lot more money and it’s put us in a really good financial position. Make sure to do your research and seek professional financial advice along the way.

Read the rest of the Ladies Talk Money teams chats here.

To celebrate Mothers Day a little differently this year, the Ladies Talk Money team used their How to Talk About Money guide to chat to their mums.

Ladies Talk Money Community Manager and Fox & Hare’s Marketing Manager, Charlotte chats with her mum, Gaenor, and her nan, Krythia about their top tips, biggest challenges and much more here –

What’s the best money or financial advice you have ever received?

G – Have a plan, budget + goal and set up the habit of saving, put an amount aside religiously.

K – borrow 100K to build a dual occupancy townhouse, even though I was near to retirement.

C – You should care about your Super. At the end of the day, your Super is YOUR money and you should care about where it’s invested, the returns and the fees associated with the fund. Making small changes can make a huge difference if you have the advantage of time.

What did your parents/grandparents/teachers/first boss teach you about money?

G – Both my Parents and Grandparents were very careful with money.(exception, my father would buy expensive items that he deemed important to him) They saved up for the item before purchase.

K – not much advice in a direct way. But early on aged 11yrs old, I learned that money is a common problem in relationships, it causes strife. (My parents took on a new business immediately after the WW2 1946, and I was the person who tried to calm the rows over money, which occurred through my early teens.

C – It’s important to have something that is your own and only your own. Whether that’s a separate bank account, an investment property, a side hustle. Talk about money and be smart with it.

How has your approach to money changed throughout your life?

G – In both my long term relationships, my Husband and my Partner were reckless with spending and money in general. Both were very good earners but always spent more than they earnt. There was no equality in the financial decisions. I was a bookkeeper and took on the role of administration for the entire household. I tried to control the spending, Tax payments and budgets. It was exhausting, soul destroying and I learnt Money = Control + I had none!

K – My approach has mainly been a cautious one, although I have taken a couple of big risks and the example : buying my home in Mosman, at age 65, post Retirement.

C – I was never really interested in money as such and didn’t see the value in learning about it past the basics.

What have been some of the biggest financial challenges in your life?

G – Trying to have a partnership with shared goals and dreams with financial matters. Never having a voice or being heard or considered. Realising that I need to have financial independence and take responsibility for myself.

K – Renovating my home, with no income coming in.

C – Paying off my credit card from my gap year in Europe. The debt totaled to $5,000 and was way easier to spend then pay off. Learned my lesson, chopped it up and haven’t had one since.

If you could give one piece of financial wisdom to future generations, what would it be?

G – Get good advice, make the time to set up goals. Discus your needs, wants, and Dreams and stick to the plan. Grow up and take responsibility for your own future.

K – Be very careful with who you get to advise you about your money. Ask for a 2nd or 3rd opinion.

C – Have a solid cash flow plan as soon as you start in the workforce. Split it into different buckets and pay yourself weekly. This has made managing my money SO much easier and even if it’s just $20 per week you are allocating to your savings or a holiday, it’s better than spending it all.

Read the rest of the Ladies Talk Money teams chats here.

Can a financial adviser help me with purchasing a home? Shouldn’t I wait until I’m old to seek financial advice? Does seeing an adviser restrict my ability to spend on leisure and weekends away? Trust us, we’ve heard it all before.

Understanding what the heck an adviser does can be incredibly confusing. And in light of the recent Banking Royal Commission, many of us are unsure and cautious about seeking professional help altogether. But to make the most of your hard-earned cash, speaking with a financial adviser who you trust can be a valuable way to boost your long-term wealth.

So, let’s debunk a few common misconceptions and uncover exactly what a financial adviser does.

The things a financial adviser can help with

So, you’re earning a decadent salary and have your sights set on making your money work as hard as you do. Whether you want to start a family, own a home in your dream suburb or guarantee an early retirement, a financial adviser can help you grow your wealth and make your long-term money goals a reality.

To help boost your wealth, financial advisers provide guidance on budgeting, investing, superannuation, estate planning, retirement planning, insurance, tax and more.

How expensive is it to work with a financial adviser?

Although the exact fees you’ll pay will depend on the adviser and arrangement you choose, financial advisers generally charge a combination of upfront and ongoing fees. These costs will be based on their level of service and amount of work completed and can include preparing financial advice strategies, making recommendations about financial products, reviewing your investment portfolio and more.

It’s important to discuss the costs of seeking financial advice with your financial adviser prior to commencing work to ensure you’re informed about the final amount.

What questions should I ask to find a good financial adviser?

When it comes to finding the right financial adviser, it’s important to find someone you can communicate open and honestly with. We recommend meeting with a few potential advisers to find the right fit for you. Some good questions to ask include:

What we do and how we help at F&H

On a decadent wage, but have nothing to show for it? Overwhelmed by too many options, choices and decisions? Want an expert by your side to make your coin work as hard as you do? You’ve come to the right place.

At Fox & Hare, we work with the next generation to help them create clarity, take control of their money and further their adventure. We help our members create the life of their dreams, whether that means starting a family, investing in property, building a passive income or starting a business. We get to know you and your unique goals and figure out the best approach to help you achieve financial freedom.

We do:

We don’t:

Never used a financial adviser before? No worries! In fact, most of our members prior to joining F&H had never seen a financial adviser either. So, we have the tools to guide you through any questions or concerns you might have, every step of the way.

So, in practical terms, how do we help?

With many of us spending more time at home, we might be looking for ways to generate an additional stream of income. Discover how to kick start your freelancing career with this practical guide to starting a side hustle.

The phrase ‘side hustle’ has been a buzz word splashed across blogs and headlines in recent years. And with good reason. Recent data from Finder has revealed that those with a side hustler are earning an average of $7,300 per year from their side income alone (as reported by Money Magazine). Plus, with 80% of Australians turning to their side hustle to find fulfillment outside of their 9-5 job, it’s no wonder the gig economy is continuing to rise in popularity worldwide.

Right now, we’re all facing a one-in-one-hundred year event: a global pandemic. With workplaces shifting their operations entirely online and many Australians facing a reduction (or loss) of their main source of income, finding ways to bolster and safeguard our wealth is at the top of everyone’s to-do list.

With the Internet at our fingertips and the majority of us stuck at home for the foreseeable future, now could be the perfect time to finally kick-start that big idea you’ve been talking about. Whether you’re on the hunt for additional work as a freelancer or want to finally launch your side hustle, discover the practical steps you need to take to turn your dreams into a reality.

Understand the commitment a side hustle requires

As with starting any business, a side hustle still requires a considerable amount of time and energy in order to become a successful source of additional income. Particularly for those balancing a side hustle or freelancing alongside a full-time role, it’s important to be realistic about your time and capacity from the beginning.

In the early stages of launching a side hustle, learning to be comfortable with ‘the juggle’ is incredibly important. This means dedicating a good chunk of time after work hours and on weekends to building your business, fostering new leads and producing work for your side hustle. To help manage your time, try using free online project management tools such as Trello or Asana to manage your to-do list and use your calendar to block out time to work through important tasks.

It’s also wise to understand the financial commitment required to launch a side hustle. You should never go into debt to kick-start a freelancing career or side project, so make sure to have a healthy savings balance first to fund any initial start-up costs that may arise. Realistically, you’ll need to be able to cover the costs of set-up (which can take up to 12 months) from your savings, so make sure you’ve budged for the ahead of time.

Where to get an ABN and how to trade mark your business

To help keep track of your side hustle transactions (and to reduce the headaches of tax time), it’s a wise idea to register for an Australian Business Number (ABN). Although this is compulsory for businesses with a GST turnover of $75,000 or more, it’s a good idea to set this up from the beginning to avoid additional paperwork down the track. To apply for an ABN, simply fill out this online application from the Australian Business Register website here.

As well as this, applying for a trade mark enables you to distinguish your offering (such as goods and services) from other businesses. There are a number of types of trade marks you can apply for depending on the type of business you’re building. To find more about the basics of trade markets, the benefits of having a trade mark and to start the application process, click here.

Plus, it’s a wise idea to register your business name with IP Australia as soon as possible (as it can take up to 4 months to approve). Be sure to get this process started early to ensure no one else snaps up your name! Find out more here.

How and when to register for GST

When launching your side hustle, it’s important to understand how and when to register for GST (the Goods and Services Tax). Essentially, it all relates to how much income your side hustle is generating.

You must be registered for GST if:

To find out more about and to register for GST, visit the ATO’s website here.

Create business accounts for your side hustle

Want to help your future self as a freelancer or side hustler? Make sure to open up separate transaction accounts specifically for your side hustle or freelancing business. Why? Because this will make reconciling and assessing your gross revenue much easier and will streamline your records to keep your personal and professional transactions separate. Plus, this will come in handy when tax time rolls around as you’ll have a specific bank account dedicated to any business income and expenses.

Track your business financials using accounting software

Once you’ve started generating an income from your side hustle, it can be easy to lose track of invoices and payments from various customers and clients. To save you time and energy, consider investing in online accounting software such as Xero or MYOB. These digital platforms are designed specifically for small businesses and help keep you to keep track of bills, create invoices, manage your cashflow in real-time and so much more.

Create channels to market your side hustle

Aside from all the administrative tasks of setting up a side hustle, another key part of starting a successful side income is to ensure you’re showcasing your work with potential clients and customers. Two practical steps you can take to do so is to launch a website (that can act as a digital portfolio or marketplace for your goods and services) as well as create a social media presence (to build brand awareness and engage with past and potential customers).

To launch a website for your side hustle, a number of online website building platforms exist including WordPress, Wix, Shopify and Squarespace. Take your time to research these options and consider which platform might be the best fit for launching your businesses’ website.

As well as this, it’s a smart idea to create social media channels (such an Instagram profile, Facebook and LinkedIn pages) to market your new business. These free marketing channels are a great way to show your goods and services in action and to share regular updates with your customers about new product launches, new services and more.

With so much volatility across the market, many investors are unsure how to proceed in this challenging period. So, here are 5 practical strategies to help you navigate this uncertain time.

It’s important to remember that market downturns are out of our control and therefore we need to focus on the things we can control in order to navigate them. Whether you’re new to the world of investing or have an extensive portfolio of assets, there are key things you can do to help set yourself up for success now and into the future. Here are the top 5 things to do in a bear market

TUNE OUT THE NOISE

Right now, checking your portfolio balance might send your down a rabbit hole of despair. So, one of the best ways to prevent making emotional decisions is to avoid frequently checking your assets in the weeks and months ahead. Plus, make sure to limit your exposure to financial news and the headlines, as this can cause you to deviate from your long-term investment strategy.

REVIEW YOUR ASSET ALLOCATION

This comes back to your tolerance for risk. Whether you’re close to retirement or are finding yourself concerned about market downturns, speaking with your financial adviser can help you make educated decisions about your asset allocation. By adjusting your split between stocks and bonds, you’ll be able to find a balance that best suits your personal circumstances and appetite for risk.

UNDERSTAND WHAT YOU CAN CONTROL

One of the best ways to manage feelings of anxiety during an uncertain like this is to focus your attention on what can control. Right now, managing the costs associated with your investments is a tangible step an investor can take to safeguard their wealth. Speak with your adviser to understand how to remove high-cost investments from your portfolio in ways that minimise the taxes due from their sale.

BE REALISTIC ABOUT YOUR EXPECTATIONS

With significant downturns across markets locally and abroad, investors should expect lower returns in the weeks and months to come. However, you can work with your financial adviser to create a strategic plan that helps to keep you on track to hit your long-term goals.

FOCUS ON DIVERSIFICATION

The investment strategy we use for all of our members at Fox & Hare emphasises the need for a diverse portfolio of assets. Why? Because this helps to insulate your portfolio and blunt the impact of downturns that may happen across the market over time. If you’d like to learn more about your particular financial situation, get in touch with us here.

With so many Australians’ jobs impacted by COVID-19, it’s important to understand what support is available to you and those in need.

WHAT TO DO IF YOU’VE LOST YOUR JOB?

Depending on your type of employment, different levels of protection exist to safeguard your job now and into the future. For permanent full-time and part-time workers, your employer can temporarily stand-down or even make you permanently redundant due to slowdowns in trade. It’s important to clarify your current employment situation and the terms of payments and notice periods with your employer in either event.

Regardless of which category you fall into, the Australian government has increased the levels of financial support available to those left without work as a result of COVID-19. The Coronavirus Supplement provides an additional payment of $550 per fortnight to new and existing income support recipients (available from April 27th for a 6 month period). Along with the existing JobSeeker payments, individuals can now receive a total of $1,100 a fortnight as a result of these changes.

To find out more about these changes, check out the Sydney Morning Herald’s explainer guide here.

ARE YOU ELIGIBLE FOR CENTRELINK PAYMENTS?

The JobSeeker Payment and additional Coronavirus Supplement is available to all Australian citizens and residents aged between 22 and 66 who are looking for work. In light of these challenging times, the usual liquid asset test waiting period has been suspended (meaning you’ll still be eligible for payment even if you have more than $5,500 as a single or $11,000 as a couple in savings). To learn more about the JobSeeker Payment, check out The Guardian’s comprehensive Q&A article here.

WHAT IS THE JOBKEEPER PAYMENT?

The JobKeeper Payment is a new wage subsidy available to employees who have been stood down or retrenched since March 1st 2020 as a result of the Coronavirus. This payment of $1,500 a fortnight is paid to employers to keep their employees afloat, and is available for full-time and part-time workers, sole traders, not-for-profits and casuals who have worked for the same employer for the last 12 months. To find out more about the JobKeeper Payment, check out Money Magazine’s helpful guide here.

SUPPORT FOR SMALL BUSINESSES

With a downturn in trade, many small businesses are struggling to manage their cash flow during this time. For those businesses suffering financial distress, a moratorium has been announced that will prevent eviction for non-payment of rent across commercial tenancies.

As well as this, the government is working to support businesses by offering:

To find out more about what support is available to small business owners, visit the Australian government’s website here.

WHAT FINANCIAL SUPPORT IS AVAILABLE FOR SOLE TRADERS?

For those working for themselves, the government has introduced a range of new measures to support you during this difficult time. These include:

To explore the full range of support options available to sole traders, visit the Australian government website here.

Discover what the outbreak of a global pandemic means for protecting your greatest asset: you.