Want the freedom, choice and flexibility to live the life you love?

We create the roadmap to get you there.

Working with a financial adviser should be straight-forward. But for too many of us, getting our financial world sorted remains at the bottom of our to-do list until retirement comes knocking.

We coach young professionals, millennials and next-gen leaders with practical, honest financial advice that meets them where they are – and takes them where they want to go.

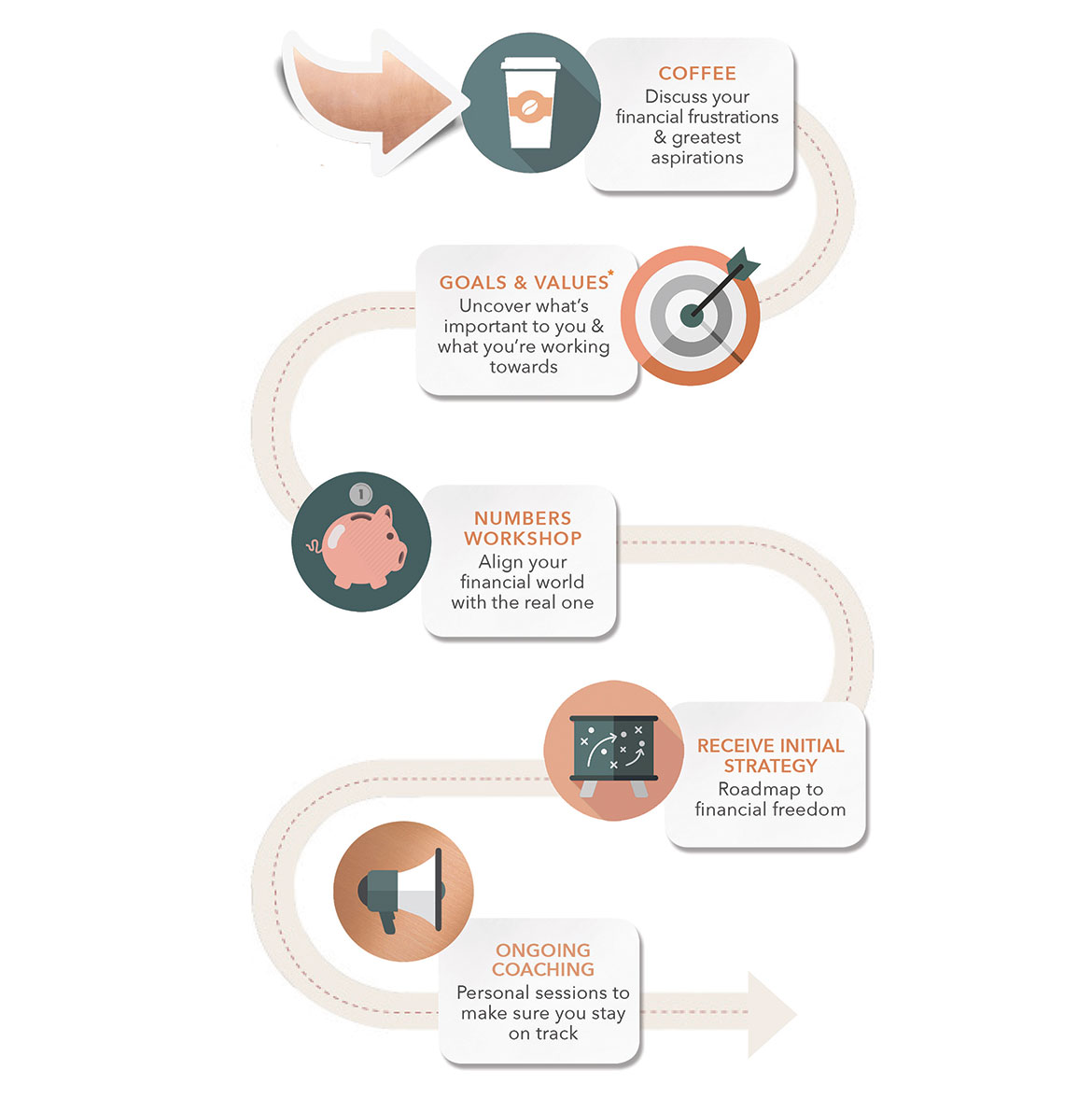

Your Advice Journey

*It’s only at the end of the Goals & Values session that you decide if Fox & Hare is the right fit for you.

The Financial Stuff We Help With

Yes, you can wine and dine while still having a healthy savings balance. Cash flow management is about understanding your buying habits, considering if they really align with your goals and creating a strategy that empowers you to live the lifestyle you love (both now and in the years to come).

Whether you’ve got an established portfolio or are just starting to think about investing – we can help! We guide our members’ investment strategies to align with their appetite for risk and goals.

Property

Whether it’s purchasing your first home or building an existing portfolio, we’ll work with you to align your life goals with the right property strategy.

Shares

Navigate the ups-and-downs of the share market with confidence. We’ll help you map out and manage a diversified investment strategy to grow your wealth and make your goals a reality.

Alternative Investment Strategies

Looking for an investment option that lowers how much you need to pay in tax each year? All investments need to be made considering their tax consequences, which is where we can help you explore alternative investment strategies that will compliment your existing portfolio and grow your wealth.

Ethical Investing

Green is the new black. More and more people are choosing to live environmentally & socially conscious lives, and this includes investing. We’ll show you how to make money while making the world a better place.

Company Options & RSUs

So, you’ve got a truckload of company options or RSU’s. Now what? For many people, an employee share scheme is their first serious step into investing. We’ll help you incorporate these funds into a diversified investment strategy, navigate tax implications and make this investment a powerful way to help you reach your long-term goals.

Ask yourself this: how long could you survive without an income?

It’s commonplace to protect our cars, our pets and our mobile phones yet very few of us insure ourselves or our incomes. The irony is that without our income, we wouldn’t have these things to begin with. Sickness, injury or a sudden change in circumstance should not destroy your goals. If plan A doesn’t go exactly as expected, we’re here to make sure you have a plan B.

Do you know your current super balance? How about where your money is invested?

Super is designed to set you up for that comfortable retirement. It’s a mandatory investment that, when managed early and proactively will increase your chances of realising the retirement of your dreams. Given you’re already investing in super, isn’t it time to start making smart choices? We’ll give you options and implement a strategy that’ll secure your golden egg.

Let’s face it: tax is unavoidable. It can, however, be reduced. With an in-depth understanding of tax, we map out strategies to help you navigate (and minimise) your tax obligations.

Maxed out credit cards, overdue bills and a painfully long wait between the tap and ‘accepted’ beep on the EFTPOS machine are all symptoms of a bad debt situation. Debt can be overwhelming, frustrating and mentally draining. Help us understand your current situation, we’ll work together and banish debt for good.

An estate plan ensures that your assets are transferred in line with your wishes, so that your loved ones are taken care of should the unthinkable occur. It’s a difficult topic to discuss, but we believe it’s important to have a plan when it’s needed most.